15 Weird Hobbies That'll Make You Better At Sandstone Yatala

The earliest types of electronic banking trace back to the advent of Atm machines as well as cards introduced in the 1960s. As the net arised in the 1980s with early broadband, digital networks started to attach retailers with suppliers as well as consumers to establish needs for early online catalogues and stock software systems.

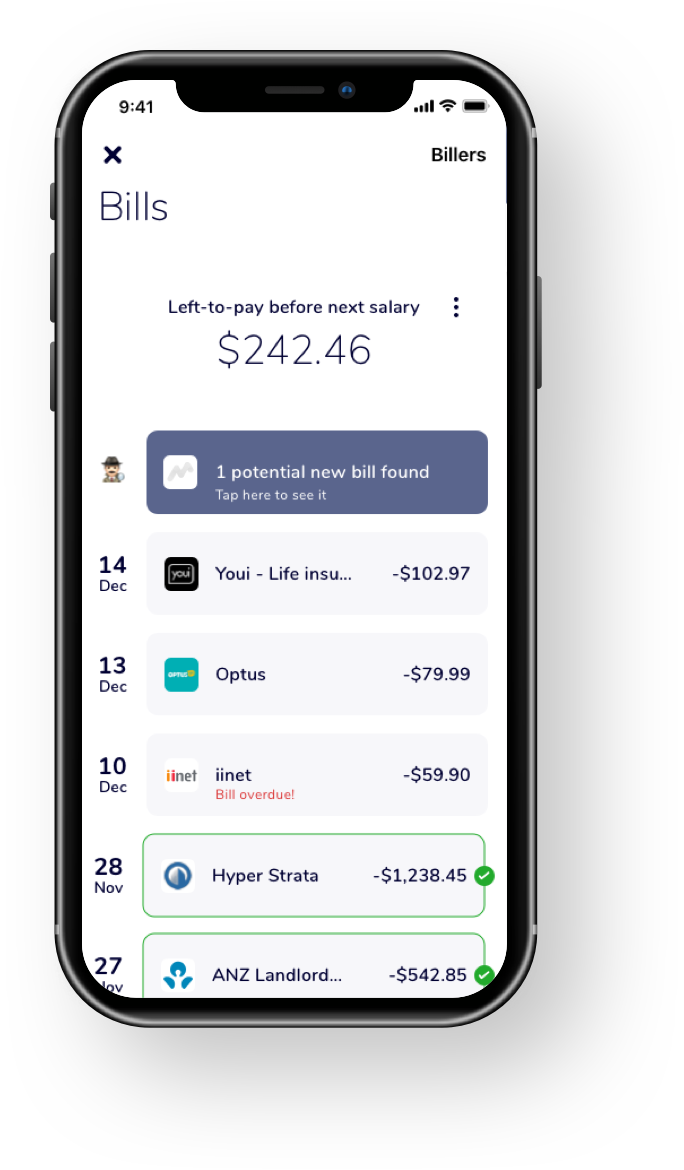

The enhancement of broadband and ecommerce systems in the very early 2000s brought about what resembled the contemporary digital banking globe today. The expansion of smart devices via the following decade opened the door for transactions on the move beyond Automated Teller Machine. Over 60% of consumers now use their smart devices as the preferred technique for electronic financial.

This dynamic shapes the basis of consumer contentment, which can be nurtured with Customer Partnership Monitoring (CRM) software program. As a result, CRM has to be integrated into an electronic banking system, considering that it supplies means for banks to straight connect with their clients. There is a demand for end-to-end uniformity and for solutions, optimized on benefit and also user experience.

In order for financial institutions to fulfill consumer needs, they need to keep concentrating on boosting digital technology that provides agility, scalability and also performance. A research conducted in 2015 exposed that 47% of lenders see prospective to enhance customer relationship through electronic financial, 44% see it as a way to create competitive advantage, 32% as a network for new client acquisition.

Significant benefits of digital financial are: Business effectiveness - Not just do digital platforms enhance communication with customers as well as deliver their requirements extra swiftly, they also give techniques for making interior functions more efficient. While banks have been at the leading edge of digital innovation at the customer end for years, they have not totally welcomed all the advantages of middleware to increase performance.

Typical bank handling is pricey, slow and also vulnerable to human mistake, according to McKinsey & Firm. Depending on individuals as well as paper likewise takes up workplace, which runs up energy as well as storage costs. Digital systems can future minimize costs via the harmonies of more qualitative information and faster feedback to market changes.

Paired with lack of IT integration between branch as well as back office personnel, this problem decreases business effectiveness. By streamlining the confirmation procedure, it's easier to apply IT solutions with business software application, causing even more accurate audit. Financial precision is critical for banks to abide with government policies. Improved competition - Digital options assist take care of advertising and marketing checklists, enabling financial institutions to get to more comprehensive markets and also develop closer partnerships with technology wise customers.

It works for implementing client benefits programs that can enhance loyalty as well as fulfillment. Greater dexterity - Using automation can accelerate both outside and internal processes, both of which can boost consumer satisfaction. Following the collapse of economic markets in 2008, an enhanced emphasis was put on danger administration.

Boosted protection - All organizations big or tiny face an expanding number of cyber dangers that can damage online reputations. In February 2016 the Internal Profits Service announced it had been hacked the previous year, as did a number of huge tech business. Banks can take advantage of extra layers of security to secure information.

By replacing hand-operated back-office procedures with automated software program remedies, banks can lower worker errors and also accelerate procedures. This standard change can lead to smaller sized functional units and permit supervisors to focus on boosting tasks that need human treatment. Automation reduces the demand for paper, which undoubtedly winds up using up space that can be occupied with innovation.

One way a bank can boost its back end business effectiveness is to separate hundreds of procedures right into 3 groups: full automated partly automated manual jobs It still isn't sensible to automate all procedures for numerous financial firms, particularly those that conduct economic testimonials or give investment guidance. Yet the more a bank can change difficult redundant handbook tasks with automation, the more it can concentrate on problems that involve direct interaction with customers.

In addition, electronic cash money can be mapped and accounted for extra accurately in instances of disputes. As consumers find a boosting number of purchasing possibilities at their fingertips, there is much less need to carry physical money in their pocketbooks. Other signs that demand for electronic money is growing are highlighted by the use peer-to-peer settlement systems such as PayPal and also the surge of untraceable cryptocurrencies such as bitcoin.

The problem is this modern technology is still not universal. Cash flow grew in the United States by 42% between 2007 and 2012, with an ordinary yearly growth rate of 7%, according to the BBC. The idea of an all electronic money economic climate is no much longer just a futuristic desire but it's still unlikely to obsolete physical money in the future.

Atm machines aid banks cut overhead, particularly if they are offered at different calculated locations past branch workplaces. Emerging kinds of digital financial are These services construct on boosted technological styles as well as various service designs. The decision for financial institutions to add more digital options in all operational levels will have a significant impact on their financial stability.

Sharma, Gaurav. " What is Digital Banking?". VentureSkies. Retrieved 1 May 2017. Kelman, James (2016 ). The Background of Banking: A Detailed Reference Source & Guide. CreateSpace Independent Posting Platform. ISBN 978-1523248926. Locke, Clayton. " The tempting rise of electronic banking". Banking Innovation. Obtained 9 May 2017. Ginovsky, John. " What really is "electronic banking"? Agreement on this oft-used term's definition avoids".

Retrieved 9 May 2017. Dias, Joao; Patnaik, Debasish; Scopa, Enrico; van Bommel, Edwin. " Automating the bank's back workplace". McKinsey & Business. Obtained 9 May 2017. Eveleth, Rose. " Will pay disappear? Many innovation cheerleaders believe so, however as Rose Eveleth uncovers, the reality is much more complicated". BBC. Obtained 9 May 2017.

Our cloud based service includes sector top security, decreasing your expenditures and giving you peace of mind. This solitary platform promotes natural growth with our huge collection of open APIs, attribute rich performance and comprehensive reporting capabilities.

You can find more information about the topic here: afr innovation summit

Sandstone Technology Group

Level 4/123 Walker St,

North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

10 Best Mobile Apps For Sandstone Suppliers Sydney

The Best Strategy To Use For Digital Banking Software Solutions - Online Banking Software

Including a wide variety of devices and also performances that cover all aspects of these tasks, it is currently important to effectively run their digital makeover. It is used to manage all procedures from front and back office for all branches of the network on several networks: Web platform, mobile application, Atm machines.

In addition to its own modules, its open design allows link to software program from various other vendors. Despite the sort of company, the number of customers as well as the volume of deals, a contemporary core banking system is flexible enough to enable personalized setups and consequently respond to any kind of details need.

In enhancement, they go through the numerous as well as strict policies, with possibly hefty consequences in situation of non-compliance. These forces all market gamers to depend on an effective technological base. Many thanks to about 20 years of industrial task, has come to be a world-renowned online. We provide substantial services composed of even more than 200 components that sustain all tasks from back office to front office.

The Only Guide for Digital Banking Software Solutions - Online Banking Software

These latter for that reason appreciate a multi-channel experience, being able to access all banking solutions on their computer or on a mobile electronic tool (phone or tablet). This adds to boost clients' contentment as well as helps maintaining them, which is essential in a scenario of boosted competitors. Being a key player in the digital financial field, we are committed to supplying banks as well as banks with modern-day, efficient, reputable as well as flexible IT devices that can perfectly satisfy their needs.

It is finished by professional assistance at all stages of the task implementation: evaluation, integration, monitoring, releasing and also also after go-live. Additionally, as a result of evolving market situations, our solutions are constantly being upgraded and updated with added performances. 450 specialists help our R & d department to develop software program with the ability https://www.sandstone.com.au of adjusting to any type of considerable modification extremely swiftly (retail banking software solutions).

is extensively renowned for its fully integrated software program that assist financial institutions in building a remarkable multi-channel customer experience. In this age where digital financial improvement is vital, having this software application expert as a partner is important to relocate in the direction of functional excellence as well as increase their end results. Adaptability is one of SAB applications' most significant benefits; thus, they cover all financial company lines.

5 Easy Facts About Digital Banking Solutions & Platform Explained

Out of 577 one-of-a-kind financial institutions in the Philippines, 450 are rural financial institutions that have a larger reach and also spread strategically throughout the nation. Nonetheless, 94% of country financial institutions have no access to an e-payment framework. This indicates most Filipinos do not have the means to acquire much easier financial gain access to. Furthermore, most available innovations and also repayment solutions need an updated phone or an excellent wifi link that is not incorporated in the Filipinos' financial practices.

The representation of banks is rapidly changing. No more is a bank an institution on Wall surface Road however instead an application on my phone. Producing organization development requires a fast adjustment to this company design. Our options resolve this transformation, permitting you to accept brand-new organization designs and define a modern-day business style.

Accepting digital is a lot more than a mobile app, however rather an omni-channel strategy. You have to map all of your consumer's desires and also after that satisfy them. More youthful consumers often tend to be 'cashless' as well as wish to transfer cash rapidly with their buddies with mobile banking. Various other customers expect individualized monetary solutions and recommendations via an electronic banking system.

Fascination About Digital Banking Solutions & Platform

At the heart of this is dependable and also protected solutions. The line of splitting up between affordable banks, including digital native Fintech firms, is so slim and blurring even more each year. As a result of that, banking service manufacturers can not manage a security slip. Clients today will promptly transfer solutions with one safety scare.

Our digital and also application service experts will certainly after that make that roadmap a truth, designing and also implementing brand-new electronic options. Our end-to-end deals will digitally transform your bank, managing danger and also driving success.

One of the critical points when a business introduces a platform whether a web site or mobile app is opening up individual accounts that allow them to be used as pocketbooks, quickening collections and permitting repayments and transfers. Financial solutions Options already exist such as BBVA APIs Accounts as well as Home mortgages that mean, With the development of ecommerce and the digitization of culture, has infected all organizations.

Unknown Facts About Digital Banking Solutions & Platform

This digitization is changing payment services at all degrees of company, from multinationals to tiny and also medium-sized ventures down to the micro-SMEs belonging to the self-employed. From payments to service providers of services and products to settling the credit scores so typical of standard regional shops, there is now a possibility to digitize the "I'll place in on the tab" in a well organized means.

These systems assist by making it easier for swiftly and also firmly - sandstone technology. first making use of charge card and afterwards with mobile financial services has actually been a historical barrier to entrance. The innovation only began to be approved by the "majorities" in the phases in the item life cycle (innovators, early adopters, very early majority and late bulk) when the very early adopters reported that they were secure.

This combination depends on the opening of an electronic account within BBVA's digital infrastructure, a considerable factor in guaranteeing safety and security. With this API, a company's consumers can open a digital account with low financial danger directly from that company's app or site, without any demand for 3rd events. And also without leaving house.

Things about Best Digital Banking Platform In 2020

Rapid, risk-free and also with just a couple of clicks. BBVA's Accounts API assists companies via the use an API incorporated right into the BBVA setting, facilitating the opening of make up customers, staff members and distributors with just a few clicks. This consists of offering customers the opportunity of connecting a debit card to the account.

When individuals intend to, they initiate a demand as well as receive an SMS with a distinct, one-time code, enabling them to trigger their new account promptly as well as safely. The contract is sent out to the client's email instantly. The new account can be carried out making use of BBVA mobile financial, inquiring information of account info, watching balances, as well as checking and also making motions.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

How To Explain Talent Bank Sydney To Your Boss

Unknown Facts About Best Digital Banking Platform In 2020

Including a wide variety of tools and also capabilities that cover all elements of these tasks, it is currently vital to successfully run their digital makeover. It is used to manage all procedures from front as well as back office for all branches of the network on numerous channels: Net platform, mobile application, ATMs.

In addition to its own modules, its open design allows connection to software application from various other providers. No matter of the sort of company, the variety of individuals and the volume of transactions, a modern-day core financial system is flexible enough to allow custom-made setups and consequently react to any kind of particular need.

Additionally, they undergo the numerous and rigorous policies, with possibly heavy consequences in case of non-compliance. These pressures all market players to count on an effective technical base. Many thanks to concerning twenty years of industrial activity, has actually come to be a world-renowned online. We provide substantial services made up of greater than 200 components that sustain all jobs from back workplace to front office.

Get This Report on Digital Banking Software Solutions - Online Banking Software

These last therefore take pleasure in a multi-channel experience, being able to accessibility all banking services on their computer system or on a mobile electronic device (phone or tablet computer). This adds to enhance clients' complete satisfaction as well as helps preserving them, which is important in a scenario of boosted competitors. Being a vital player in the digital banking area, we are committed to offering financial institutions and also banks with modern, efficient, dependable and adaptable IT tools that can perfectly satisfy their requirements.

It is finished by expert support in all phases of the project application: evaluation, combination, management, launching as well as also after go-live. In addition, as a result of progressing market circumstances, our solutions are frequently being updated and also upgraded with added capabilities. 450 experts benefit our Study as well as Advancement department to create software program capable of adapting to any type of substantial adjustment really quickly (digital banking solutions companies).

is commonly renowned for its fully integrated software that aid banks in building a remarkable multi-channel customer experience. In this age where electronic banking improvement is essential, having this software specialist as a companion is vital to move in the direction of functional quality as well as raise their outcomes. Versatility is among SAB applications' biggest advantages; hence, they cover all banking company lines.

The Buzz on Digital Banking Software Solutions - Online Banking Software

Out of 577 unique banks in the Philippines, 450 are country financial institutions that have a wider reach as well as scattered purposefully throughout the country. However, 94% of country banks have no access to an e-payment framework. This implies most Filipinos do not have the ways to acquire simpler financial accessibility. Additionally, most offered innovations and settlement solutions require an updated phone or a great wifi link that is not integrated in the Filipinos' financial behaviors.

The representation of banks is swiftly changing. No much longer is a financial institution an establishment on Wall Road however rather an application on my phone. Creating service growth calls for a fast change to this company version. Our services address this improvement, allowing you to embrace new company designs as well as define a modern-day service architecture.

Welcoming electronic is much more than a mobile app, however instead an omni-channel strategy. You need to map all of your client's desires as well as after that satisfy them. Younger clients have a tendency to be 'cashless' and also intend to move cash promptly with their pals with mobile financial. Other customers anticipate personalized economic services as well as suggestions through an electronic banking system.

How Best Digital Banking Platform In 2020 can Save You Time, Stress, and Money.

At the heart of this is trusted and protected solutions. The line of separation in between competitive financial institutions, consisting of digital indigenous Fintech firms, is so narrow as well as obscuring even more yearly. Due to that, banking solution manufacturers can not pay for a safety slip. Customers today will promptly move solutions with one protection scare.

Our digital and also application service specialists will after that make that roadmap a fact, making and also applying brand-new digital options. Our end-to-end offers will electronically transform your bank, managing danger and driving productivity.

One of the critical points when a company launches a platform whether a site or mobile app is opening individual accounts that enable them to be used as wallets, speeding up collections and permitting settlements as well as transfers. Financial solutions Options currently exist such as BBVA APIs Accounts as well as Home mortgages that mean, With the growth of ecommerce and also the digitization of culture, has infected all companies.

The Best Guide To Digital Banking Solutions & Platform

This digitization is changing repayment services in all degrees of organization, from multinationals to small and also medium-sized enterprises down to the micro-SMEs belonging to the independent. From settlements to companies of services and products to repaying the credit so typical of typical neighborhood stores, there is currently an opportunity to digitize the "I'll place in on the tab" in a well organized means.

These systems assist by making it less complicated for quickly as well as firmly - sandstone technology. first using charge card and afterwards with mobile banking solutions has actually been a historic barrier to access. The modern technology only started to be accepted by the "majorities" in the phases in the item life process (pioneers, very early adopters, early majority and also late majority) when the very early adopters reported that they were secure.

This combination depends upon the opening of an electronic account within BBVA's digital framework, a significant point in ensuring safety. With this API, a firm's customers can open a digital account with low economic threat straight from that firm's app or site, without any requirement for third events. As well as without leaving house.

Getting My Digital Banking Solutions To Work

Fast, risk-free and with just a couple of clicks. BBVA's Accounts API aids business through the usage an API integrated right into the BBVA setting, assisting in the opening of accounts for consumers, workers as well as vendors with simply a couple of clicks. This consists of offering individuals the opportunity of linking a debit card to the account.

When individuals wish to, they start a demand and receive an SMS with a special, single code, https://www.sandstone.com.au allowing them to activate their brand-new account promptly and securely. The contract is sent to the customer's email automatically. The new account can be carried out making use of BBVA mobile financial, querying information of account details, seeing balances, as well as checking and also making motions.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

15 Most Underrated Skills That'll Make You A Rockstar In The Mobile Banking App Industry

The Best Strategy To Use For Best Digital Banking Platform In 2020

Including a broad variety of tools as well as performances that cover all elements of these activities, it is currently important to effectively operate their electronic transformation. It is used to handle all operations from front and back workplace for all branches of the network on several networks: Net system, mobile application, ATMs.

In addition to its own components, its open design enables connection to software application from other providers. Despite the sort of organization, the number of customers and the quantity of transactions, a modern core banking system is flexible sufficient to allow custom setups as well as as a result react to any type of details need.

Furthermore, they go through the several as well as stringent regulations, with potentially hefty effects in instance of non-compliance. These pressures all market gamers to depend on an effective technical base. Thanks to concerning twenty years of business activity, has actually ended up being a world-renowned online. We use considerable options made up of even more than 200 modules that sustain all tasks from back office to front office.

The Single Strategy To Use For Digital Banking Solutions

These last consequently take pleasure in a multi-channel experience, being able to gain access to all financial services on their computer system or on a mobile digital tool (phone or tablet computer). This contributes to improve clients' contentment as well as aids retaining them, which is essential in a situation of increased competition. Being a principal in the electronic financial field, we are devoted to giving financial institutions and also monetary establishments with modern-day, effective, reliable as well as versatile IT tools that can completely satisfy their needs.

It is completed by experienced support whatsoever stages of the job implementation: evaluation, integration, administration, releasing and also also after go-live. Additionally, as a result of developing market conditions, our remedies are constantly being updated as well as updated with extra functionalities. 450 specialists help our R & d department to develop software efficient in adjusting to any kind of considerable adjustment really rapidly (sandstone technology).

is widely renowned for its completely integrated software program that assist financial institutions in building an outstanding multi-channel client experience. In this age where electronic financial improvement is essential, having this software program specialist as a partner is important to move in the direction of functional excellence as well as increase their results. Versatility is one of SAB applications' largest advantages; thus, they cover all banking business lines.

Digital Banking Software Solutions - Online Banking Software Things To Know Before You Buy

Out of 577 special banks in the Philippines, 450 are country financial institutions that have a broader reach and scattered purposefully throughout the nation. Nevertheless, 94% of country financial institutions have no access to an e-payment infrastructure. This implies most Filipinos lack the methods to obtain less complicated financial accessibility. In addition, most readily available modern technologies and payment remedies require an updated phone or a good wifi connection that is not integrated in the Filipinos' economic behaviors.

The representation of banks is rapidly changing. No more is a financial institution an institution on Wall surface Street but rather an application on my phone. Producing company development calls for a quick modification to this business version. Our solutions resolve this change, enabling you to accept brand-new company designs and define a modern company architecture.

Embracing digital is a lot more than a mobile app, but instead an omni-channel strategy. You must map every one of your customer's wants and after that satisfy them. More youthful customers often tend to be 'cashless' and want to transfer cash promptly with their pals with mobile banking. Other consumers anticipate customized monetary services and suggestions by means of an on the internet banking system.

How Digital Banking Software Solutions - Online Banking Software can Save You Time, Stress, and Money.

At the heart of this is reliable and also safe and secure services. The line of splitting up between affordable financial institutions, including electronic indigenous Fintech companies, is so slim and obscuring more each year. As a result of that, banking solution manufacturers can not afford a protection slip. Consumers today will swiftly move services with one protection scare.

Our digital and application service experts will then make that roadmap a fact, creating and also executing brand-new electronic options. Our end-to-end offers will digitally change your bank, managing danger as well as driving earnings.

Among the crucial points when a firm launches a system whether a web site or mobile app is opening individual accounts that allow them to be utilized as budgets, speeding up collections and enabling payments and transfers. Banking solutions Options currently exist such as BBVA APIs Accounts and Mortgages that mean, With the growth of ecommerce as well as the digitization of culture, has spread out to all companies.

What Does Digital Banking Software Solutions - Online Banking Software Do?

This digitization is changing payment solutions in any way levels of business, from multinationals to tiny and also medium-sized enterprises to the micro-SMEs coming from the freelance. From payments to companies of items as well as solution to paying off the debt so normal of standard local stores, there is now a chance to digitize the "I'll place in on the tab" in an organized method.

These systems help by making it less complicated for swiftly as well as safely - banking technology. first making use of charge card and afterwards via mobile financial services has actually been a historic obstacle to entry. The modern technology only began to be approved by the "majorities" in the stages in the item life cycle (innovators, very early adopters, very early majority and also late bulk) when the very early adopters reported that they were safe and secure.

This assimilation depends upon the opening of a digital account within BBVA's digital infrastructure, a significant point in guaranteeing safety and security. With this API, a firm's consumers can open a electronic account with low monetary threat straight from that firm's application or website, without need for 3rd parties. And also without leaving residence.

Getting My Digital Banking Solutions To Work

Fast, safe and also https://www.sandstone.com.au with simply a few clicks. BBVA's Accounts API aids firms with the use an API integrated right into the BBVA atmosphere, promoting the opening of make up consumers, employees and also suppliers with just a couple of clicks. This includes offering individuals the possibility of linking a debit card to the account.

When customers wish to, they start a request as well as receive an SMS with an one-of-a-kind, one-time code, allowing them to trigger their brand-new account promptly as well as firmly. The contract is sent out to the consumer's email automatically. The new account can be carried out making use of BBVA mobile banking, querying details of account info, checking out equilibriums, as well as checking as well as making activities.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

The Worst Advice You Could Ever Get About Sandstone Characteristics

5 Simple Techniques For Digital Banking Solutions

Featuring a variety of tools and performances that cover all elements of these activities, it is currently vital to effectively run their electronic change. It is used to manage all operations from front and back workplace for all branches of the network on several networks: Net system, mobile application, ATMs.

In addition to its very own components, its open style allows connection to software from other distributors. No matter of the kind of organization, the variety of users and also the quantity of purchases, a modern-day core banking system is flexible sufficient to allow custom configurations and also consequently reply to any type of particular need.

In addition, they undergo the several as well as strict policies, with possibly heavy consequences in case of non-compliance. These forces all market gamers to count on an effective technological base. Many thanks to about two decades of commercial activity, has actually come to be a world-renowned online. We provide extensive solutions composed of greater than 200 modules that sustain all tasks from back office to front workplace.

Digital Banking Solutions Fundamentals Explained

These latter therefore delight in a multi-channel experience, having the ability to gain access to all banking solutions on their computer or on a mobile electronic gadget (phone or tablet). This contributes to boost customers' satisfaction and helps maintaining them, which is crucial in a situation of raised competition. Being a vital gamer in the electronic financial field, we are devoted to providing banks and banks with contemporary, efficient, trusted and flexible IT devices that can perfectly fulfill their requirements.

It is completed by expert support whatsoever phases of the project application: evaluation, assimilation, management, launching and also also after go-live. Furthermore, due to advancing market conditions, our solutions are constantly being updated and also updated with additional capabilities. 450 experts function for our R & d department to create software qualified of adapting to any kind of substantial modification very rapidly (digital banking solutions companies).

is widely renowned for its totally integrated software program that assist financial institutions in developing a phenomenal multi-channel customer experience. In this age where electronic financial change is critical, having this software program professional as a partner is necessary to relocate in the direction of functional quality as well as elevate their outcomes. Versatility is one of SAB applications' greatest advantages; thus, they cover all financial business lines.

Excitement About Best Digital Banking Platform In 2020

Out of 577 special financial institutions in the Philippines, 450 are rural banks that have a larger reach and also spread tactically throughout the nation. Nevertheless, 94% of rural financial institutions have no accessibility to an e-payment facilities. This suggests most Filipinos do not have the ways to obtain simpler monetary accessibility. In addition, most available technologies and settlement options require an updated phone or a great wifi connection that is not integrated in the Filipinos' economic practices.

The depiction of banks is rapidly altering. No more is a bank an establishment on Wall surface Street but instead an application on my phone. Creating organization growth requires a quick change to this service version. Our options resolve this transformation, permitting you to embrace new company models as well as specify a modern company architecture.

Accepting digital is far more than a mobile app, yet instead an omni-channel method. You should map every one of your client's desires and after that meet them. More youthful consumers often tend to be 'cashless' and also wish to transfer money quickly with their close friends with mobile banking. Various other clients expect customized monetary services as well as guidance via an electronic banking system.

Getting My Best Digital Banking Platform In 2020 To Work

At the heart of this is reliable as well as secure solutions. The line of separation in between https://www.sandstone.com.au competitive financial institutions, consisting of digital indigenous Fintech companies, is so slim as well as blurring more each year. Due to that, banking solution producers can not pay for a safety slip. Consumers today will quickly move solutions with one protection scare.

Our electronic and also application solution specialists will certainly after that make that roadmap a truth, designing and implementing new digital options. Our end-to-end offers will digitally transform your bank, taking care of threat and driving success.

One of the crucial points when a firm introduces a platform whether an internet site or mobile app is opening up individual accounts that enable them to be used as wallets, speeding up collections and allowing settlements and also transfers. Banking services Options currently exist such as BBVA APIs Accounts and Mortgages that mean, With the growth of ecommerce and also the digitization of society, has actually spread out to all organizations.

Little Known Questions About Best Digital Banking Platform In 2020.

This digitization is transforming payment services whatsoever degrees of service, from multinationals to little as well as medium-sized ventures down to the micro-SMEs coming from the independent. From settlements to providers of product or services to repaying the credit scores so normal of conventional neighborhood stores, there is now a chance to digitize the "I'll place in on the tab" in a well organized method.

These systems help by making it much easier for swiftly and securely - retail banking software solutions. first using financial institution cards and after that through mobile banking solutions has actually been a historic barrier to entrance. The modern technology only began to be accepted by the "bulks" in the stages in the product life cycle (innovators, early adopters, very early bulk and also late majority) when the early adopters reported that they were secure.

This integration depends upon the opening of an electronic account within BBVA's digital facilities, a substantial point in making sure safety and security. With this API, a company's consumers can open up a electronic account with low economic threat directly from that company's application or web site, with no need for third parties. And also without leaving residence.

Some Of Digital Banking Solutions & Platform

Quick, safe and also with simply a couple of clicks. BBVA's Accounts API assists firms through the usage an API integrated right into the BBVA environment, promoting the opening of represent consumers, employees as well as distributors with simply a couple of clicks. This consists of offering individuals the opportunity of connecting a debit card to the account.

When customers wish to, they start a request and also get an SMS with a special, single code, enabling them to trigger their new account quickly and also firmly. The contract is sent to the customer's e-mail immediately. The new account can be administered using BBVA mobile banking, inquiring information of account information, watching balances, and monitoring and making activities.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

10 Things Everyone Hates About Website Technologies

What Does Digital Banking Solutions Do?

Featuring a variety of tools and also performances that cover all elements of these tasks, it is now important to effectively run their digital transformation. It is utilized to handle all procedures from front as well as back office for all branches of the network on numerous networks: Net platform, mobile application, ATMs.

In addition to its very own components, its open architecture permits connection to software from various other vendors. Despite the kind of service, the number of individuals as well as the volume of transactions, a modern core banking system is adaptable sufficient to permit personalized setups and also consequently reply to any type of particular demand.

On top of that, they undergo the numerous as well as strict regulations, with potentially hefty consequences in situation of non-compliance. These pressures all market players to rely upon a powerful technical base. Thanks to regarding two decades of business task, has come to be a world-renowned online. We provide comprehensive services composed of greater than 200 components that sustain all tasks from back office to front workplace.

Some Known Facts About Digital Banking Software Solutions - Online Banking Software.

These last as a result take pleasure in a multi-channel experience, having the ability to gain access to all financial solutions on their computer or on a mobile digital device (phone or tablet). This adds to boost consumers' complete satisfaction and helps maintaining them, which is essential in a circumstance of enhanced competition. Being an essential player in the electronic financial field, we are dedicated to supplying financial institutions and also economic organizations with modern-day, reliable, dependable and versatile IT tools that can perfectly meet their demands.

It is finished by professional assistance whatsoever phases of the project application: analysis, integration, management, launching as well as even after go-live. Furthermore, because of developing market conditions, our remedies are regularly being updated and upgraded with additional performances. 450 experts benefit our Research study and also Development department to develop software application efficient in adapting to any type of considerable change really rapidly (digital broker solutions).

is widely renowned for its totally incorporated software that help banks in building an extraordinary multi-channel customer experience. In this age where electronic banking makeover is crucial, having this software program professional as a partner is important to relocate towards operational excellence and raise their outcomes. Versatility is among SAB applications' biggest advantages; thus, they cover all banking service lines.

Digital Banking Solutions Things To Know Before You Buy

Out of 577 one-of-a-kind banks in the Philippines, 450 are country financial institutions that have a broader reach as well as scattered strategically throughout the nation. Nonetheless, 94% of rural financial institutions have no access to an e-payment framework. This means most Filipinos do not have the ways to acquire less complicated https://www.sandstone.com.au economic access. Additionally, most available technologies and payment remedies need an upgraded phone or an excellent wifi connection that is not included in the Filipinos' monetary behaviors.

The representation of banks is quickly changing. No much longer is a bank an organization on Wall surface Street yet instead an application on my phone. Creating company growth requires a fast modification to this service version. Our remedies address this improvement, enabling you to accept brand-new service versions and define a modern-day business style.

Embracing electronic is far more than a mobile app, however instead an omni-channel technique. You need to map all of your customer's wants and after that meet them. Younger customers tend to be 'cashless' and intend to transfer money swiftly with their friends with mobile financial. Other customers expect personalized monetary solutions and recommendations through an on-line financial system.

An Unbiased View of Best Digital Banking Platform In 2020

At the heart of this is trusted and safe and secure services. The line of separation between competitive banks, consisting of electronic indigenous Fintech companies, is so narrow and obscuring more every year. Due to the fact that of that, banking service manufacturers can not manage a safety slip. Consumers today will rapidly transfer solutions with one security scare.

Our digital and also application solution experts will then make that roadmap a fact, developing and applying brand-new electronic options. Our end-to-end offers will electronically transform your bank, taking care of threat and also driving profitability.

Among the crucial points when a firm introduces a system whether a site or mobile app is opening up user accounts that allow them to be used as wallets, accelerating collections and enabling repayments and transfers. Banking services Alternatives already exist such as BBVA APIs Accounts and Mortgages that mean, With the growth of ecommerce as well as the digitization of society, has infected all services.

The 9-Minute Rule for Digital Banking Solutions

This digitization is transforming payment solutions whatsoever levels of company, from multinationals to tiny as well as medium-sized enterprises down to the micro-SMEs belonging to the freelance. From payments to service providers of products as well as service to repaying the credit so common of standard local shops, there is currently a possibility to digitize the "I'll place in on the tab" in a well organized means.

These systems assist by making it simpler for quickly and securely - digital lending solutions. first making use of bank cards and afterwards through mobile banking solutions has actually been a historical barrier to entrance. The modern technology only started to be approved by the "bulks" in the phases in the product life cycle (trendsetters, early adopters, very early bulk as well as late majority) when the very early adopters reported that they were secure.

This integration depends on the opening of a digital account within BBVA's electronic infrastructure, a significant factor in guaranteeing safety and security. With this API, a firm's consumers can open up a digital account with low economic danger straight from that business's application or website, without requirement for 3rd parties. And without leaving house.

Not known Details About Best Digital Banking Platform In 2020

Rapid, safe as well as with simply a couple of clicks. BBVA's Accounts API aids business through the use an API incorporated right into the BBVA setting, helping with the opening of represent customers, workers as well as vendors with simply a few clicks. This consists of offering users the opportunity of linking a debit card to the account.

When individuals wish to, they initiate a demand and receive an SMS with a special, single code, enabling them to activate their new account promptly and also safely. The agreement is sent to the consumer's e-mail instantly. The new account can be carried out utilizing BBVA mobile banking, inquiring details of account information, seeing equilibriums, and also checking as well as making movements.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

Enough Already! 15 Things About Home Finance Software Australia We're Tired Of Hearing

The 4-Minute Rule for Digital Banking Solutions

Featuring a vast range of devices and functionalities that cover all facets of these tasks, it is now vital to successfully operate their electronic transformation. It is used to take care of all procedures from front and back office for all sandstone steps branches of the network on numerous channels: Net platform, mobile application, ATMs.

In addition to its very own components, its open architecture enables link to software application from various other providers. No matter the sort of company, the number of users and the quantity of transactions, a modern core banking system is flexible sufficient to enable customized arrangements and also therefore react to any type of particular requirement.

Furthermore, they go through the numerous and also rigorous regulations, with potentially heavy effects in instance of non-compliance. These forces all market players to count on a powerful technical base. Many thanks to concerning two decades of commercial task, has actually ended up being a world-renowned online. We provide considerable remedies composed of greater than 200 components that support all tasks from back office to front workplace.

Unknown Facts About Digital Banking Solutions

These last consequently appreciate a multi-channel experience, being able to gain access to all financial solutions on their computer system or on a mobile electronic device (phone or tablet computer). This adds to boost customers' fulfillment and also aids keeping them, which is crucial in a circumstance of increased competitors. Being a principal in the digital financial area, we are committed to supplying banks and also banks with modern-day, reliable, dependable and also adaptable IT tools that can flawlessly satisfy their demands.

It is completed by professional support in all stages of the task execution: analysis, combination, monitoring, introducing and even after go-live. In addition, due to advancing market situations, our services are continuously being upgraded and also updated with extra functionalities. 450 professionals help our Research and Advancement division to create software with the ability of adjusting to any significant adjustment really swiftly (digital solutions in banking).

is extensively renowned for its completely integrated software that assist banks in constructing a phenomenal multi-channel client experience. In this age where digital financial change is important, having this software program professional as a partner is necessary to relocate towards functional excellence as well as increase their results. Flexibility is just one of SAB applications' largest advantages; hence, they cover all banking organization lines.

The Ultimate Guide To Digital Banking Software Solutions - Online Banking Software

Out of 577 unique banks in the Philippines, 450 are country banks that have a wider reach and spread purposefully throughout the country. Nevertheless, 94% of rural banks have no accessibility to an e-payment framework. This indicates most Filipinos do not have the ways to acquire easier economic access. In addition, most offered modern technologies as well as payment remedies require an upgraded phone or an excellent wifi link that is not incorporated in the Filipinos' monetary routines.

The representation of financial organizations is quickly altering. No more is a bank an establishment on Wall surface Street yet instead an application on my phone. Producing organization development needs a quick adjustment to this business design. Our options resolve this makeover, allowing you to accept brand-new business designs as well as define a modern-day organization style.

Accepting digital is a lot more than a mobile application, but rather an omni-channel technique. You should map all of your customer's wants and afterwards meet them. Younger customers have a tendency to be 'cashless' as well as wish to transfer money quickly with their pals with mobile financial. Various other customers expect individualized financial solutions and suggestions by means of an on-line banking system.

The smart Trick of Digital Banking Solutions & Platform That Nobody is Talking About

At the heart of this is reputable and secure services. The line of separation between competitive financial institutions, including digital native Fintech companies, is so slim as well as blurring even more each year. Due to that, banking solution producers can not pay for a safety slip. Customers today will swiftly transfer services with one security scare.

Our electronic and also application solution experts will certainly then make that roadmap a fact, making as well as carrying out new electronic options. Our end-to-end offers will digitally transform your bank, taking care of risk and driving profitability.

One of the important points when a business launches a platform whether a web site or mobile app is opening customer accounts that allow them to be made use of as budgets, speeding up collections as well as permitting settlements as well as transfers. Financial services Options already exist such as BBVA APIs Accounts and Home loans that mean, With the growth of ecommerce and the digitization of society, has infected all businesses.

An Unbiased View of Digital Banking Solutions

This digitization is transforming payment services whatsoever levels of company, from multinationals to small and medium-sized ventures to the micro-SMEs coming from the independent. From repayments to companies of services and products to paying off the credit so normal of traditional neighborhood shops, there is currently a chance to digitize the "I'll place in on the tab" in an organized way.

These systems assist by making it much easier for swiftly and safely - banking software. initially using financial institution cards as well as then through mobile banking services has actually been a historical barrier to entry. The technology only started to be accepted by the "bulks" in the stages in the product life cycle (trendsetters, very early adopters, early majority and late bulk) when the early adopters reported that they were protected.

This integration depends upon the opening of a digital account within BBVA's electronic infrastructure, a significant factor in making certain safety and security. With this API, a business's customers can open up a digital account with reduced economic threat straight from that firm's application or site, without any requirement for third parties. As well as without leaving residence.

What Does Digital Banking Solutions Mean?

Rapid, risk-free and with simply a couple of clicks. BBVA's Accounts API aids companies with the use an API integrated into the BBVA setting, promoting the opening of accounts for customers, staff members and also vendors with just a few clicks. This includes offering users the possibility of connecting a debit card to the account.

When users intend to, they launch a demand and receive an SMS with a distinct, single code, enabling them to trigger their new account promptly and also safely. The contract is sent to the consumer's e-mail immediately. The new account can be carried out using BBVA mobile banking, quizing details of account information, seeing balances, and checking as well as making motions.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

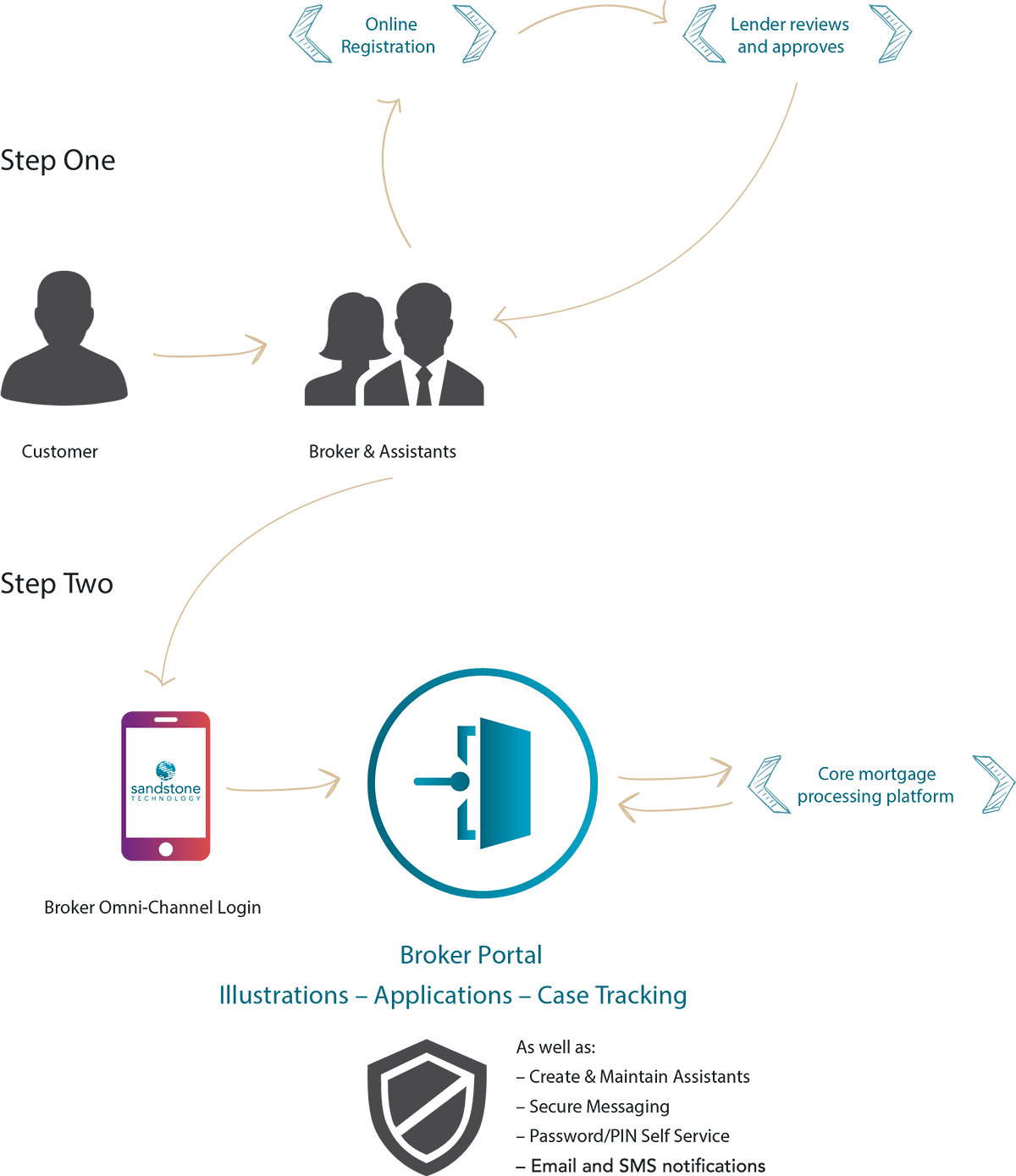

10 Celebrities Who Should Consider A Career In Broker Portal

Digital Banking Solutions & Platform Can Be Fun For Everyone

Including a variety of tools as well as capabilities that cover all elements of these activities, it is now necessary to effectively operate their electronic improvement. It is utilized to deal with all procedures from front as well as back office for all branches of the network on several channels: Internet system, mobile application, Atm machines.

On top of its very own modules, its open style allows connection to software program from various other suppliers. No matter of the kind of company, the number of customers and the volume of deals, a modern core financial system is adaptable enough to enable custom configurations and also therefore react to any kind of certain need.

Additionally, they undergo the multiple as well as rigorous guidelines, with potentially hefty consequences in situation of non-compliance. These pressures all market gamers to depend on a powerful technological base. Thanks to about two decades of industrial task, has ended up being a world-renowned online. We provide considerable options made up of greater than 200 modules that support all jobs from back workplace to front office.

Some Known Details About Digital Banking Solutions

These last as a result appreciate a multi-channel experience, being able to access all banking services on their computer system or on a mobile electronic gadget (phone or tablet computer). This adds to boost consumers' complete satisfaction and aids preserving them, which is essential in a circumstance of raised competitors. Being a principal in the digital financial area, we are committed to offering financial institutions and banks with modern-day, reliable, dependable and adaptable IT tools that can perfectly fulfill their needs.

It is completed by expert support whatsoever stages of the task application: analysis, integration, management, launching and also also after go-live. In addition, as a result of advancing market conditions, our remedies are constantly being upgraded and also upgraded with additional capabilities. 450 experts help our R & d division to develop software program capable of adapting to any kind of considerable adjustment really quickly (banking technology).

is commonly renowned for its fully integrated software program that aid banks in constructing an exceptional multi-channel client experience. In this age where electronic banking improvement is essential, having this software expert as a companion is vital to move in the direction of functional excellence and also increase their outcomes. Flexibility is among SAB applications' greatest advantages; thus, they cover all banking business lines.

Some Known Facts About Digital Banking Solutions.

Out of 577 special financial institutions in the Philippines, 450 are rural financial institutions that have a bigger reach as well as spread tactically throughout the country. Nevertheless, 94% of country banks have no access to an e-payment infrastructure. This implies most Filipinos do not have the ways to acquire easier monetary sandstone steps accessibility. In addition, most available technologies and payment solutions require an upgraded phone or a great wifi link that is not integrated in the Filipinos' monetary behaviors.

The depiction of banks is quickly changing. No longer is a bank an institution on Wall Street yet instead an application on my phone. Developing service growth needs a quick modification to this organization design. Our options address this improvement, permitting you to accept new organization versions as well as specify a modern company style.

Accepting electronic is a lot even more than a mobile app, but instead an omni-channel approach. You must map every one of your customer's desires and after that satisfy them. Younger consumers tend to be 'cashless' as well as intend to transfer cash swiftly with their friends with mobile financial. Other clients expect customized economic solutions as well as recommendations through an online financial platform.

The Facts About Digital Banking Solutions Uncovered

At the heart of this is trusted as well as protected services. The line of splitting up in between affordable banks, consisting of electronic indigenous Fintech companies, is so narrow and also blurring more yearly. As a result of that, banking service manufacturers can not manage a security slip. Customers today will quickly move services with one safety and security scare.

Our electronic and application solution experts will after that make that roadmap a truth, creating and also implementing new digital options. Our end-to-end offers will electronically transform your bank, taking care of danger and also driving profitability.

Among the crucial points when a business introduces a platform whether a site or mobile app is opening individual accounts that allow them to be utilized as wallets, accelerating collections and also permitting repayments and transfers. Banking services Options currently exist such as BBVA APIs Accounts as well as Home loans that mean, With the growth of ecommerce and also the digitization of society, has actually spread to all companies.

What Does Digital Banking Solutions Mean?

This digitization is changing repayment solutions in any way degrees of business, from multinationals to tiny as well as medium-sized enterprises down to the micro-SMEs belonging to the self-employed. From settlements to carriers of products and also service to paying off the credit so normal of standard neighborhood stores, there is now an opportunity to digitize the "I'll place in on the tab" in an organized means.

These systems aid by making it less complicated for swiftly as well as safely - digital solutions in banking. initially using charge card and after that through mobile financial services has actually been a historical obstacle to entry. The technology just began to be accepted by the "majorities" in the stages in the item life process (innovators, very early adopters, early majority and late majority) when the early adopters reported that they were safe.

This combination depends upon the opening of an electronic account within BBVA's electronic framework, a significant point in ensuring safety and security. With this API, a business's customers can open up a digital account with low monetary danger straight from that company's app or website, without any requirement for 3rd parties. And without leaving residence.

The Single Strategy To Use For Digital Banking Solutions

Rapid, risk-free as well as with just a couple of clicks. BBVA's Accounts API helps business with the usage an API integrated right into the BBVA atmosphere, promoting the opening of accounts for customers, staff members as well as suppliers with simply a few clicks. This consists of offering users the possibility of linking a debit card to the account.

When users want to, they start a request and also receive an SMS with an one-of-a-kind, one-time code, allowing them to trigger their new account quickly as well as safely. The agreement is sent to the consumer's email automatically. The new account can be administered utilizing BBVA mobile financial, quizing information of account information, checking out equilibriums, and monitoring and also making motions.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

15 Best Twitter Accounts To Learn About Digital Banking

Digital Banking Solutions & Platform Can Be Fun For Everyone

Including a variety of tools and performances that cover all aspects of these activities, it is now necessary to successfully operate their digital transformation. It is used to manage all operations from front and back workplace for all branches of the network on multiple channels: Web system, mobile application, Atm machines.

In addition to its own modules, its open style permits link to software from other vendors. No matter of the kind of service, the number of individuals as well as the volume of transactions, a contemporary core banking system is flexible sufficient to enable custom-made arrangements and consequently react to any kind of certain demand.

In addition, they are subject to the numerous as well as rigorous laws, with potentially hefty effects in situation of non-compliance. These pressures all market gamers to count on an effective technological base. Many thanks to about twenty years of commercial task, has actually ended up being a world-renowned online. We offer considerable options composed of even more than 200 components that sustain all tasks from back office to front workplace.

The Only Guide to Digital Banking Software Solutions - Online Banking Software

These last therefore delight in a multi-channel experience, having the ability to access all financial solutions on their computer or on a mobile electronic tool (phone or tablet computer). This adds to improve clients' fulfillment and aids preserving them, which is crucial in a circumstance of increased competitors. Being a vital gamer in the electronic banking area, we are dedicated to offering banks and banks with modern, effective, reliable as well as adaptable IT devices that can flawlessly satisfy their demands.

It is finished by expert assistance in all phases of the task implementation: evaluation, integration, management, introducing and even after go-live. Moreover, as a result of progressing market scenarios, our remedies are regularly being updated and upgraded with extra performances. 450 experts help our Research and Growth department to establish software capable of adapting to any kind of considerable change really promptly (digital lending solutions).

is widely renowned for its totally incorporated software application that help financial institutions in building an exceptional multi-channel consumer experience. In this age where electronic banking improvement is essential, having this software expert as a companion is necessary to move in the direction of operational quality and also elevate their outcomes. Adaptability is just one of SAB applications' biggest benefits; hence, they cover all banking company lines.

Best Digital sandstone steps Banking Platform In 2020 - Questions

Out of 577 unique banks in the Philippines, 450 are rural financial institutions that have a bigger reach and also scattered tactically throughout the nation. Nevertheless, 94% of country financial institutions have no accessibility to an e-payment infrastructure. This indicates most Filipinos do not have the methods to acquire less complicated financial access. Additionally, most offered modern technologies as well as settlement remedies require an upgraded phone or a great wifi link that is not integrated in the Filipinos' monetary behaviors.

The representation of banks is quickly changing. No longer is a bank an organization on Wall surface Road however rather an application on my phone. Producing service growth calls for a rapid change to this company version. Our options address this change, allowing you to welcome new service models and also define a contemporary organization design.

Welcoming electronic is far more than a mobile app, but rather an omni-channel strategy. You have to map every one of your client's wants and after that fulfill them. Younger clients have a tendency to be 'cashless' and also intend to move money rapidly with their close friends with mobile financial. Various other consumers anticipate personalized monetary solutions as well as suggestions through an electronic banking platform.

Digital Banking Solutions for Dummies

At the heart of this is reputable and protected services. The line of separation between competitive banks, consisting of digital indigenous Fintech firms, is so slim and obscuring even more annually. Due to that, banking service manufacturers can not manage a safety and security slip. Consumers today will rapidly move services with one safety and security scare.

Our electronic and application solution specialists will after that make that roadmap a truth, designing and carrying out new digital solutions. Our end-to-end offers will electronically transform your financial institution, handling danger and also driving productivity.

One of the crucial points when a business introduces a system whether a web site or mobile app is opening individual accounts that enable them to be used as budgets, speeding up collections as well as allowing payments and also transfers. Financial solutions Alternatives currently exist such as BBVA APIs Accounts as well as Mortgages that mean, With the growth of ecommerce as well as the digitization of society, has actually infected all businesses.

10 Simple Techniques For Digital Banking Software Solutions - Online Banking Software

This digitization is changing repayment solutions in any way levels of business, from multinationals to small and medium-sized business down to the micro-SMEs belonging to the freelance. From settlements to carriers of product or services to paying off the credit report so common of traditional regional shops, there is now a chance to digitize the "I'll put in on the tab" in an organized method.

These systems help by making it much easier for quickly and also firmly - digital banking solutions companies. first utilizing bank cards and then through mobile banking services has actually been a historical obstacle to entry. The technology just started to be accepted by the "bulks" in the phases in the product life cycle (trendsetters, very early adopters, early bulk and also late bulk) when the early adopters reported that they were safe and secure.

This combination relies on the opening of a digital account within BBVA's digital facilities, a substantial point in making certain safety. With this API, a company's customers can open a digital account with reduced monetary danger straight from that company's app or internet site, without any requirement for third parties. And without leaving home.

Digital Banking Solutions Can Be Fun For Everyone

Rapid, risk-free and also with simply a couple of clicks. BBVA's Accounts API aids companies through the usage an API integrated into the BBVA setting, promoting the opening of accounts for clients, staff members and also suppliers with simply a couple of clicks. This consists of offering customers the possibility of connecting a debit card to the account.

When individuals intend to, they launch a request and receive an SMS with a special, single code, allowing them to trigger their brand-new account promptly as well as safely. The contract is sent out to the client's e-mail immediately. The brand-new account can be carried out using BBVA mobile financial, inquiring information of account information, viewing equilibriums, and monitoring and making motions.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

15 Tips About Sandstones From Industry Experts

What Does Digital Banking Solutions Mean?

Featuring a vast array of devices as well as capabilities that cover all facets of these tasks, it is currently vital to effectively operate their electronic change. It is made use of to handle all operations from front and back workplace for all branches of the network on several channels: Web platform, mobile application, ATMs.

On top of its very own components, its open design enables link to software program from various other vendors. Regardless of the sort of company, the number of customers as well as the quantity of deals, a contemporary core banking system is versatile enough to permit custom-made arrangements and therefore reply to any kind of details requirement.

In enhancement, they are subject to the numerous and rigorous policies, with possibly hefty effects in instance of non-compliance. These forces all market players to rely on a powerful technical base. Many thanks to regarding two decades of business task, has actually become a world-renowned online. We provide considerable services made up of greater than 200 modules that support all tasks from back office to front office.

10 Easy Facts About Digital Banking Solutions Explained

These latter for that reason enjoy a multi-channel experience, being able to gain access to all financial services on their computer or on a mobile electronic tool (phone or tablet computer). This adds to enhance clients' complete satisfaction as well as aids retaining them, which is crucial in a scenario of boosted competitors. Being a crucial gamer in the digital financial area, we are dedicated to offering financial institutions as well as banks with modern, reliable, reputable and also adaptable IT tools that can flawlessly meet their demands.

It is finished by skilled support whatsoever stages of the project execution: analysis, assimilation, management, introducing as well as even after go-live. Furthermore, as a result of progressing market circumstances, our options are continuously being updated and upgraded with extra capabilities. 450 specialists help our R & d division to develop software application with the ability of adapting to any kind of considerable modification extremely swiftly (digital banking).

is commonly renowned for its fully incorporated software application that assist banks in constructing an exceptional multi-channel client document verification ai experience. In this age where electronic banking change is vital, having this software expert as a partner is important to move towards functional quality and also raise their end results. Flexibility is just one of SAB applications' most significant advantages; hence, they cover all financial organization lines.

The 30-Second Trick For Best Digital Banking Platform In 2020

Out of 577 special banks in the Philippines, 450 are country banks that have a wider reach and also scattered tactically throughout the country. Nonetheless, 94% of rural financial institutions have no access to an e-payment infrastructure. This indicates most Filipinos lack the ways to get less complicated monetary gain access to. In addition, most available modern technologies as well as payment remedies need an upgraded phone or a good wifi connection that is not integrated in the Filipinos' monetary habits.

The depiction of banks is swiftly transforming. No more is a financial institution an establishment on Wall Road however rather an application on my phone. Creating service development calls for a quick change to this service version. Our remedies resolve this makeover, allowing you to welcome new organization versions as well as specify a contemporary business style.

Welcoming digital is far more than a mobile application, however rather an omni-channel method. You need to map every one of your client's wants and afterwards satisfy them. More youthful clients have a tendency to be 'cashless' as well as intend to move cash quickly with their good friends with mobile banking. Various other customers expect customized monetary solutions and advice by means of an on-line financial platform.

The Definitive Guide to Digital Banking Solutions & Platform

At the heart of this is reliable and secure services. The line of splitting up between competitive financial institutions, consisting of electronic indigenous Fintech firms, is so narrow as well as blurring even more annually. As a result of that, banking service manufacturers can not pay for a protection slip. Clients today will swiftly transfer services with one safety and security scare.

Our electronic as well as application solution professionals will then make that roadmap a truth, creating as well as implementing brand-new digital solutions. Our end-to-end deals will digitally change your financial institution, handling danger as well as driving profitability.

One of the crucial points when a company launches a system whether a website or mobile app is opening up user accounts that allow them to be used as pocketbooks, accelerating collections and allowing payments and transfers. Financial solutions Choices currently exist such as BBVA APIs Accounts and also Home loans that mean, With the growth of ecommerce and the digitization of society, has spread out to all services.

The Facts About Digital Banking Solutions Uncovered

This digitization is changing payment solutions whatsoever levels of service, from multinationals to little as well as medium-sized ventures to the micro-SMEs belonging to the self-employed. From payments to suppliers of product or services to settling the debt so regular of conventional regional shops, there is currently a chance to digitize the "I'll place in on the tab" in a well organized means.

These systems aid by making it easier for quickly as well as safely - digital banking solutions companies. initially utilizing financial institution cards as well as then with mobile financial solutions has actually been a historical obstacle to entrance. The innovation only began to be approved by the "majorities" in the stages in the item life process (pioneers, very early adopters, very early bulk and also late bulk) when the very early adopters reported that they were secure.

This assimilation depends upon the opening of a digital account within BBVA's digital infrastructure, a significant point in ensuring safety. With this API, a firm's customers can open a digital account with reduced economic danger directly from that company's app or web site, without any need for third celebrations. And also without leaving residence.

Some Known Questions About Digital Banking Solutions.

Fast, safe and also with just a few clicks. BBVA's Accounts API assists firms through the usage an API incorporated right into the BBVA setting, facilitating the opening of make up consumers, workers and vendors with simply a couple of clicks. This consists of offering individuals the opportunity of connecting a debit card to the account.

When customers wish to, they start a request and receive an SMS with an unique, single code, allowing them to trigger their new account rapidly as well as safely. The contract is sent out to the consumer's email automatically. The brand-new account can be provided using BBVA mobile banking, inquiring information of account info, viewing balances, and monitoring and also making motions.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

mebank com au internet banking: Expectations vs. Reality

Getting The Crowe Brandvoice: The Future Of Digital Banking - Forbes To Work

Digital financial belongs to the broader context for the step to on-line banking, where financial solutions are provided over the web. The change from typical to digital financial has actually been steady as well as stays recurring, and also is comprised by varying levels of financial service digitization. Digital banking includes high levels of procedure automation as well as online services and might consist of APIs enabling cross-institutional solution composition to deliver banking products and also offer transactions. anz bank app for android.

An electronic bank represents a virtual procedure that includes electronic banking and past. As an end-to-end platform, digital banking must encompass the front end that consumers see, the backside that lenders translucent their web servers and admin control board as well as the middleware that attaches these nodes - online banking solutions inc. Ultimately, a digital bank should facilitate all practical degrees of banking on all solution delivery platforms.

The factor digital banking is greater than simply a mobile or on-line system is that it consists of middleware solutions. Middleware is software that bridges running systems or databases with other applications. Monetary sector divisions such as danger management, product growth and also advertising and marketing need to likewise be included between and back end to truly be considered a complete digital financial institution.

The Best Guide To Digital Banking - Pymnts.com

The earliest forms of digital banking trace back to the development of Atm machines as well as cards introduced in the 1960s. As the net emerged in the 1980s with early broadband, digital networks started to link merchants with distributors and customers to develop needs for very early on the internet brochures as well as stock software systems.